-

High Costs and Fees Reverse mortgages come with various fees that can add up quickly. Let's break them down: These costs can significantly impact your budget and how much you receive from the reverse mortgage. Before jumping in, take a…

-

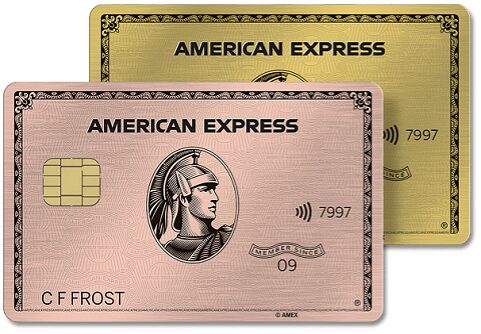

The Best Credit Cards of 2025 for Every Type of Spender

Picking a credit card in 2025 is like choosing a new phone — it comes down to how you plan to use it. A travel card might earn you thousands in rewards… if you’re jet-setting regularly. But if your “trips”…

-

Personal Loans for Fair Credit

Credit scores are numerical representations of your creditworthiness, typically ranging from 300 to 850. They’re calculated based on various factors that lenders use to assess the risk of lending you money. Before diving into loan options, it’s essential to understand…

-

22 Top Debt Consolidation Tips

22. Assess Your Debt Load Understanding your debt balance versus income is crucial. Calculate your debt-to-income (DTI) ratio by dividing your total monthly debt payments by your gross monthly income. Lenders often view a DTI below 36% favorably, while exceeding…

-

Best Business Credit Card Rewards of 2025

The best business credit cards in 2025 do more than sit in your wallet. They give you meaningful returns on purchases you were already going to make — from software subscriptions and advertising to office supplies and gas. Whether you’re…

-

Best Travel Business Credit Cards

If your business spends on client dinners, conference fees or ride-shares, the right travel business credit card can turn those costs into rewards you’ll actually use. And if you’re managing team expenses, even better — a well-chosen card can generate…

-

The Best Travel Reward Credit Cards

There’s no shortage of “best travel card” lists out there — but many of them skip over what really matters: how these cards perform for actual people. What’s the redemption experience like? Are the perks worth the hype? Is the…

-

Guaranteed Loan Approval

Understanding No Credit Loans No credit loans offer a financial lifeline for those who've never borrowed before. These loans cater to emergencies like car repairs or unexpected medical bills, providing an opportunity to borrow without the usual credit checks. The…

-

How to Apply for Financial Hardship Relief

Financial hardship can hit anyone — whether it’s from job loss, medical bills, or just the high cost of staying afloat. The good news? If you’re struggling, many lenders, service providers, and agencies do offer relief. But they usually won’t…

-

The Best Travel Credit Cards: 2025 Reviews

Travel credit cards have come a long way in the past decade. What used to be a premium-only category reserved for business flyers and high rollers is now a smart tool for anyone looking to stretch their dollars on flights,…

-

Reverse Mortgage Tips and Info

Understanding Reverse Mortgages Reverse mortgages are a financial tool for homeowners 62 and up, allowing them to convert home equity into cash while staying in their homes. Unlike traditional mortgages, the lender pays you based on your equity. The eligible…

-

Immediate Hardship Loans

Understanding Hardship Loans When life throws you a curveball, hardship loans can be a financial lifeline. These loans help cover essential costs like rent or groceries during tough times. To qualify, you'll need to show proof of your hardship, like…

-

Need Loan Bad Credit

Understanding Debt Consolidation Loans Juggling multiple debts can feel overwhelming. Debt consolidation loans offer a way to simplify by combining various debts into one monthly payment, often with a lower interest rate. This can make managing your finances easier and…

-

Small Business Credit Insight

Establishing Business Credit Establishing business credit is crucial for your company's financial health. Follow these key steps: Choose lenders that report to the major credit bureaus: Dun & Bradstreet, Experian, and Equifax. Consistent, on-time payments will improve your credit score,…

-

How to Pay Less in Taxes and Grow Your Future: The Ultimate Guide to Tax-Deductible Investing

Let’s face it—taxes can be confusing. So can investing. Put them together and most people tune out. But here’s the thing: understanding tax-deductible investments is one of the smartest money moves you can make. If you’ve ever thought: You’re in…